Chapter 9: Random variables

STAT 1010 - Fall 2022

Learning outcomes

By the end of this lesson you should:

Know how to find the mean given a probability mass or distribution function

Understand how to use multiplication and addition rules to find expected values and variance of new random variables

Revision - 1

Find the mean, and variance for these examples:

\(20, 24, 25, 36, 25, 22, 23\)

Rolling a fair six-sided die

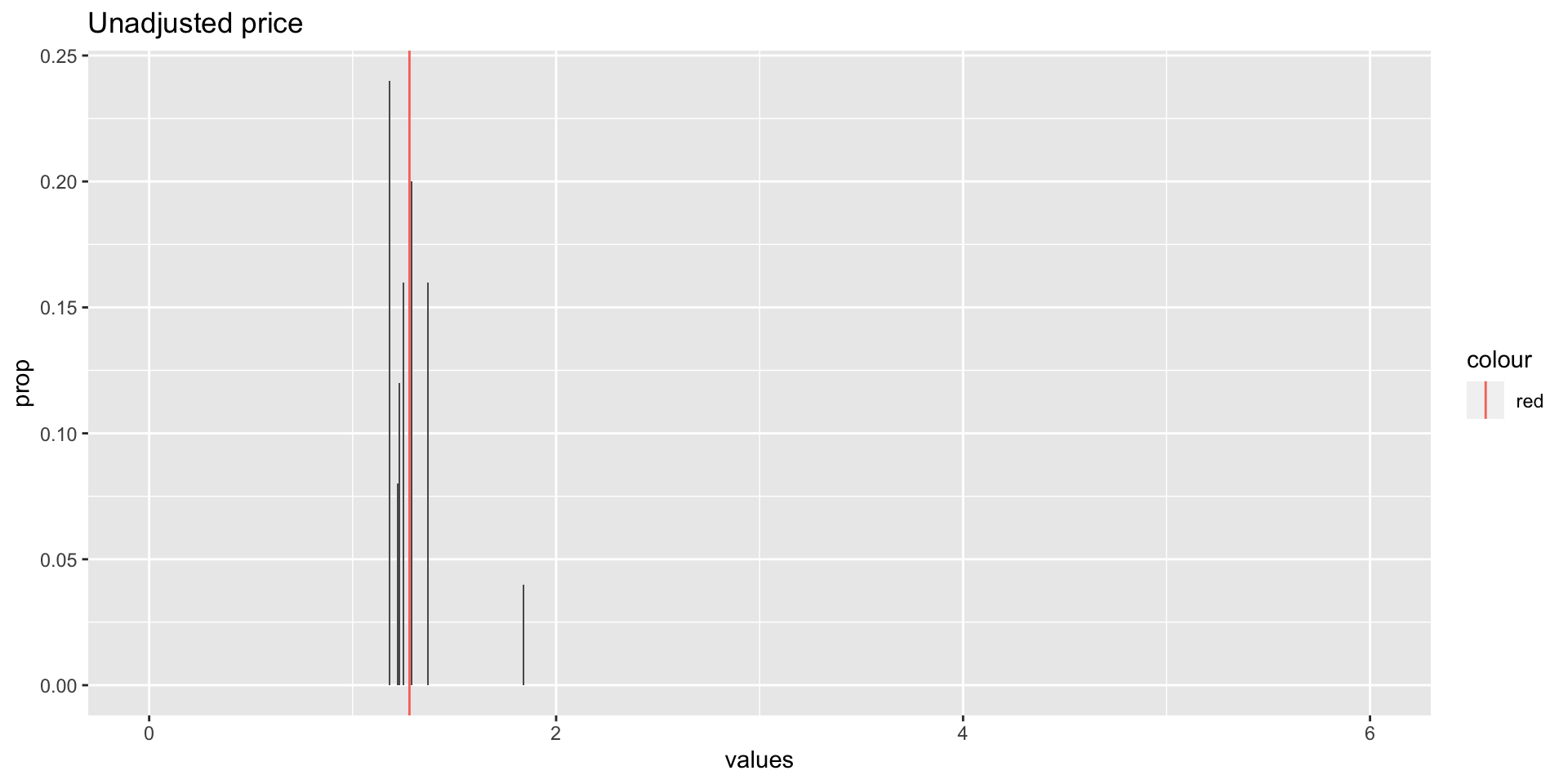

Revision - 2

A stock prices (\(X\)) at these frequencies:

| \(x\) | \(n\) |

|---|---|

| 1.23 | 3 |

| 1.29 | 5 |

| 1.37 | 4 |

| 1.84 | 1 |

| 1.18 | 6 |

| 1.22 | 2 |

| 1.25 | 4 |

| Total | 25 |

Using proportions

| \(x\) | \(n\) | \(P(X) = x\) |

|---|---|---|

| 1.23 | 3 | |

| 1.29 | 5 | |

| 1.37 | 4 | |

| 1.84 | 1 | |

| 1.18 | 6 | |

| 1.22 | 2 | |

| 1.25 | 4 | |

| Total | 25 |

Mean or expected value

If we know $P(X) = x$, then we can use this to find the mean or expected value of a random variable. The pdf includes information about both the total and the number of occurrences of \(x\), it does the computation for us.

\(\mu = E(X)\)

\(= x_1p(x_1) + x_2p(x_2) + … + x_np(x_n)\)

Probability density function

There are different ways to define a pdf:

table

plot

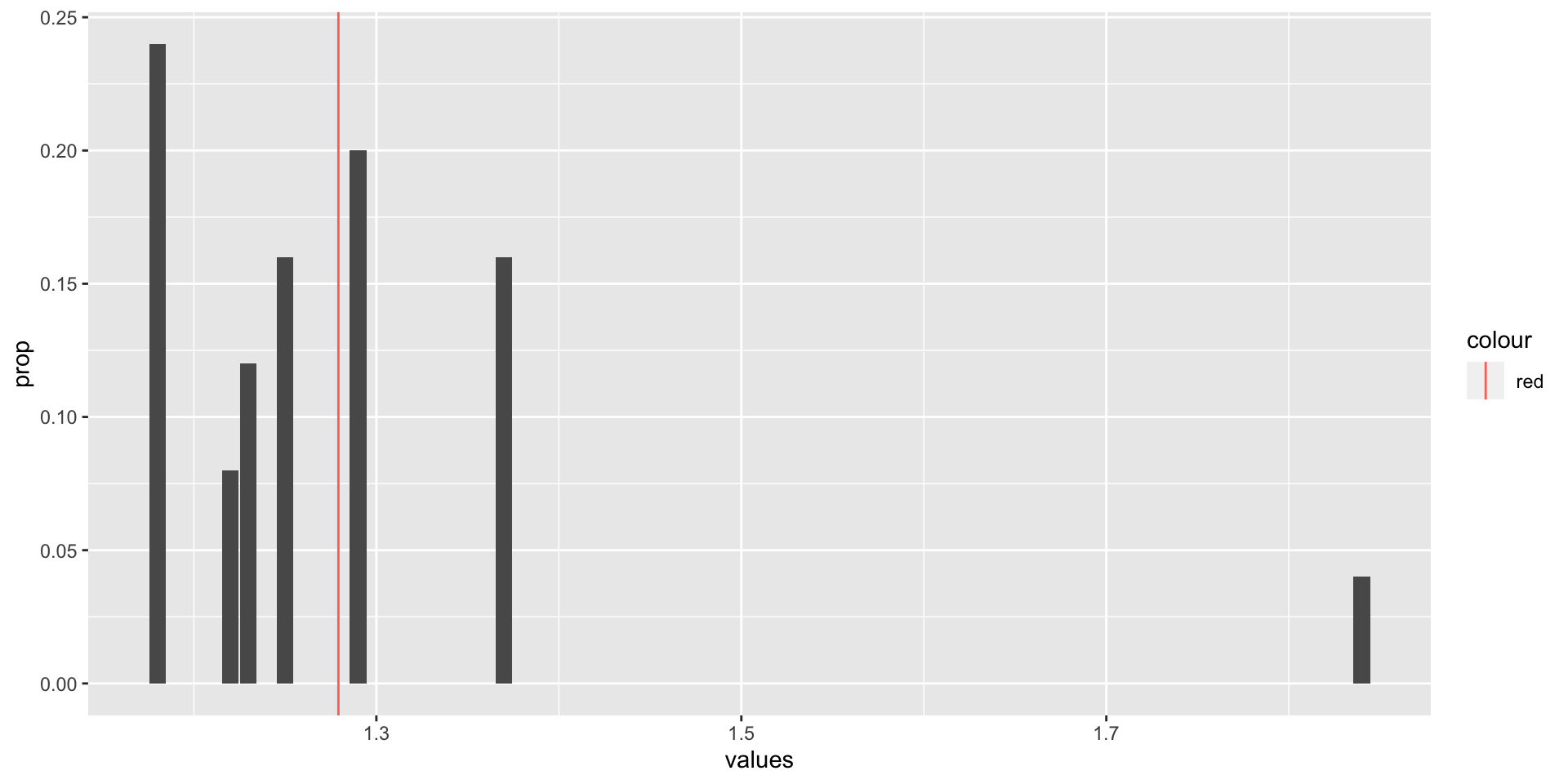

plot - pdf

## Input data

values <- c(1.23, 1.29, 1.37, 1.84, 1.18, 1.22, 1.25)

counts <- c(3, 5, 4, 1, 6, 2, 4)

d <-

as_tibble(data.frame(values, counts)) %>% # make tibble

mutate(prop = counts/sum(counts), # find proportion

part_mean = values*prop, # multiply values & prop

mean = sum(part_mean)) # find the sum

d %>%

ggplot(aes(x = values, y = prop)) + # for values and prop

geom_bar(stat = "identity") + # make bar chart of identity (prop)

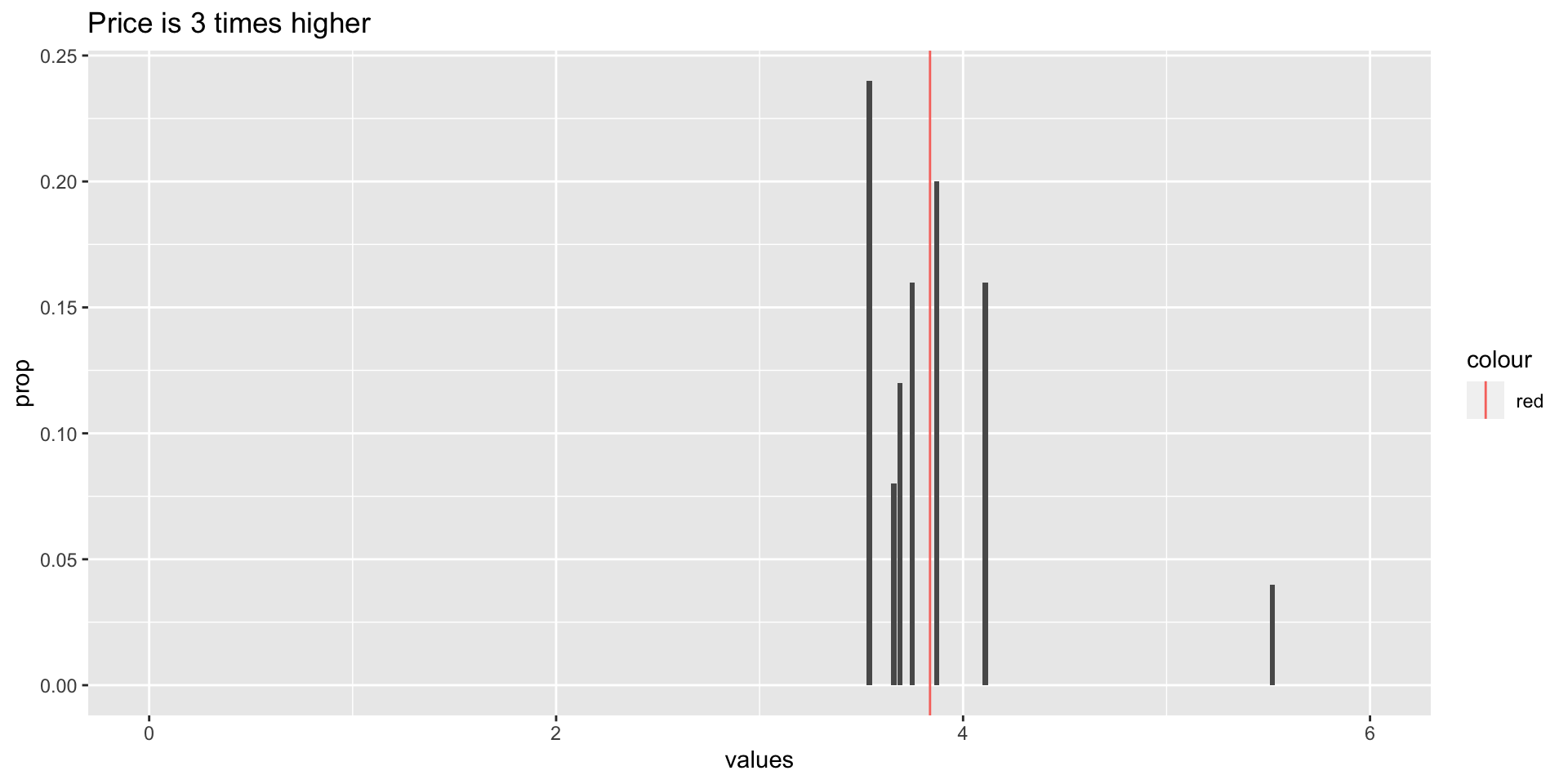

geom_vline(aes(xintercept = mean, color = "red")) # and line of meanPrice increase

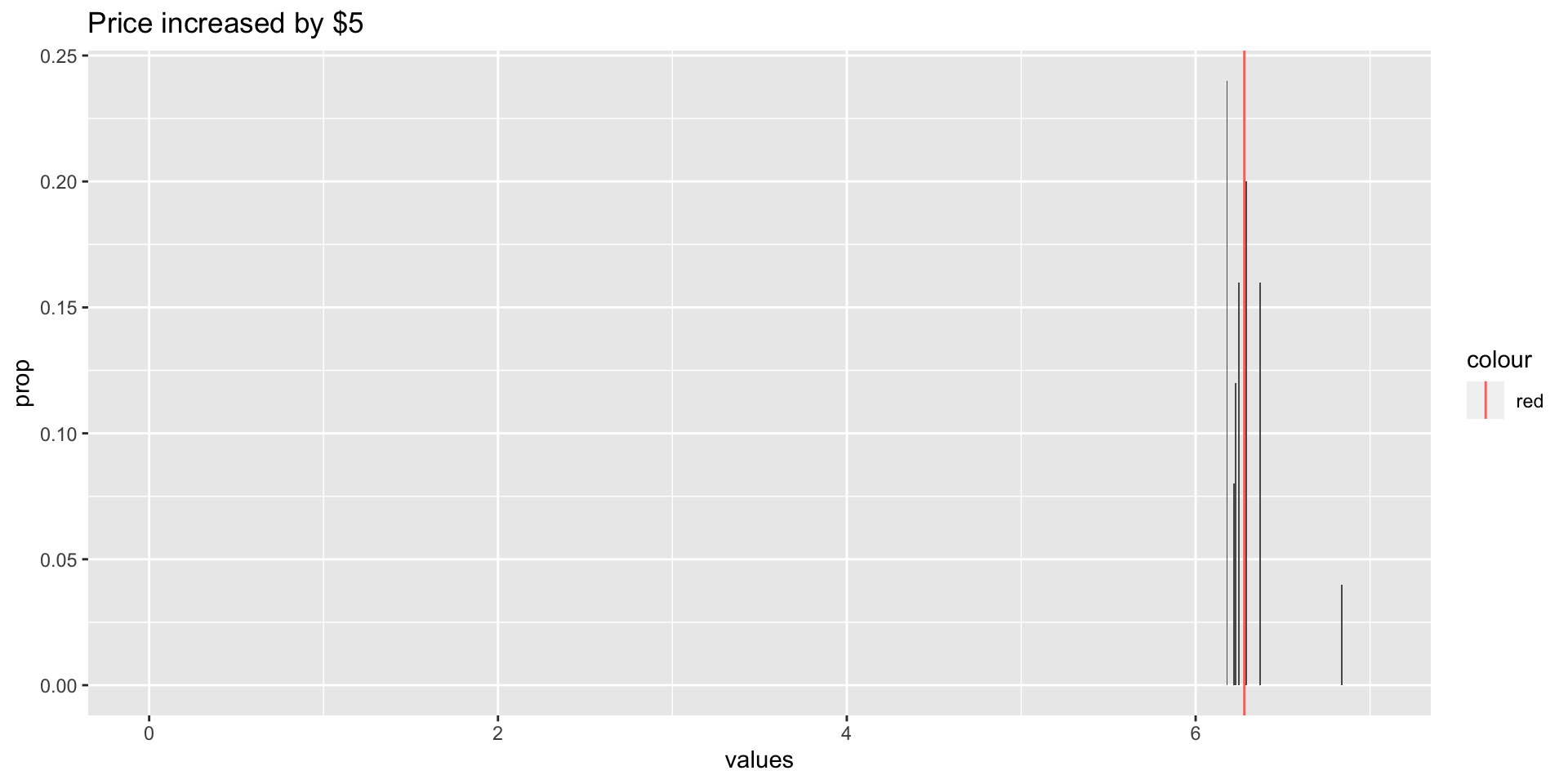

All the stock values have increased by $5:

What happens to the mean?

What happens to the standard deviation?

Price increase

| \(x\) | \(x + 5\) | \(P(X) = x+5\) |

|---|---|---|

| 1.23 | 6.23 | 0.12 |

| 1.29 | 6.29 | 0.20 |

| 1.37 | 6.37 | 0.16 |

| 1.84 | 6.84 | 0.04 |

| 1.18 | 6.18 | 0.24 |

| 1.22 | 6.22 | 0.08 |

| 1.25 | 6.25 | 0.16 |

Price increase

Adding a constant

\(E(X \pm c) = E(X) \pm c\)

\(SD(X \pm c) = SD(X)\)

\(Var(X \pm c) = Var(X)\)

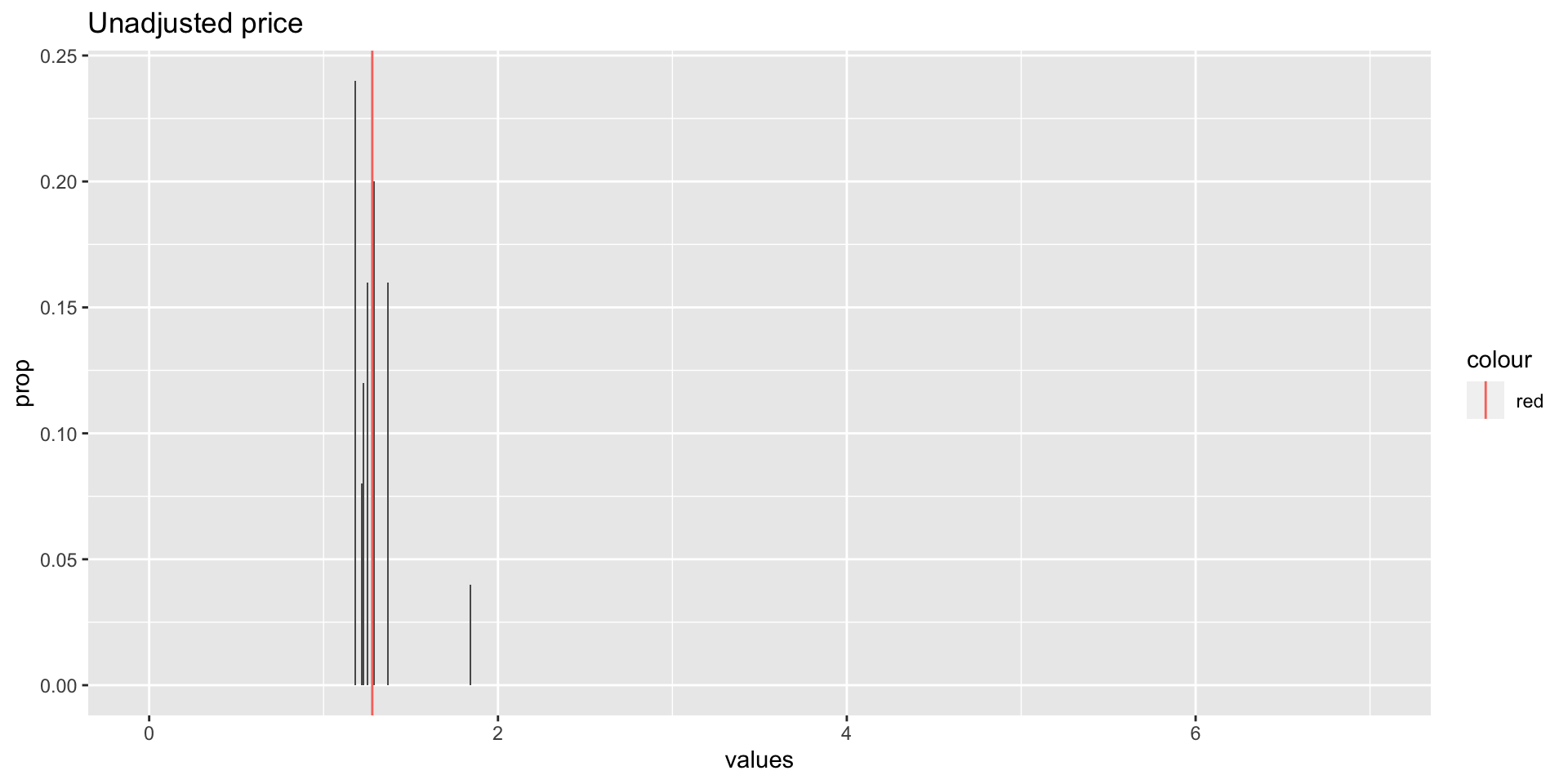

Stock splits

Without decreasing the cost, the stock values are now 3 times what they were before:

What happens to the mean?

What happens to the standard deviation?

Stock splits

| \(x\) | \(3x\) | \(P(X) = x\) |

|---|---|---|

| 1.23 | 3.68 | 0.12 |

| 1.29 | 3.87 | 0.20 |

| 1.37 | 4.11 | 0.16 |

| 1.84 | 5.52 | 0.04 |

| 1.18 | 3.54 | 0.24 |

| 1.22 | 3.66 | 0.08 |

| 1.25 | 3.75 | 0.16 |

Stock splits

Multiply by a constant

\(E(cX) = cE(X)\)

\(SD(cX) = |c|SD(X)\)

\(Var(cX) = c^2Var(X)\)

\(E(cX \pm a)=cE(X) \pm a\)

\(Var(cX \pm a)=c^2Var(X)\)

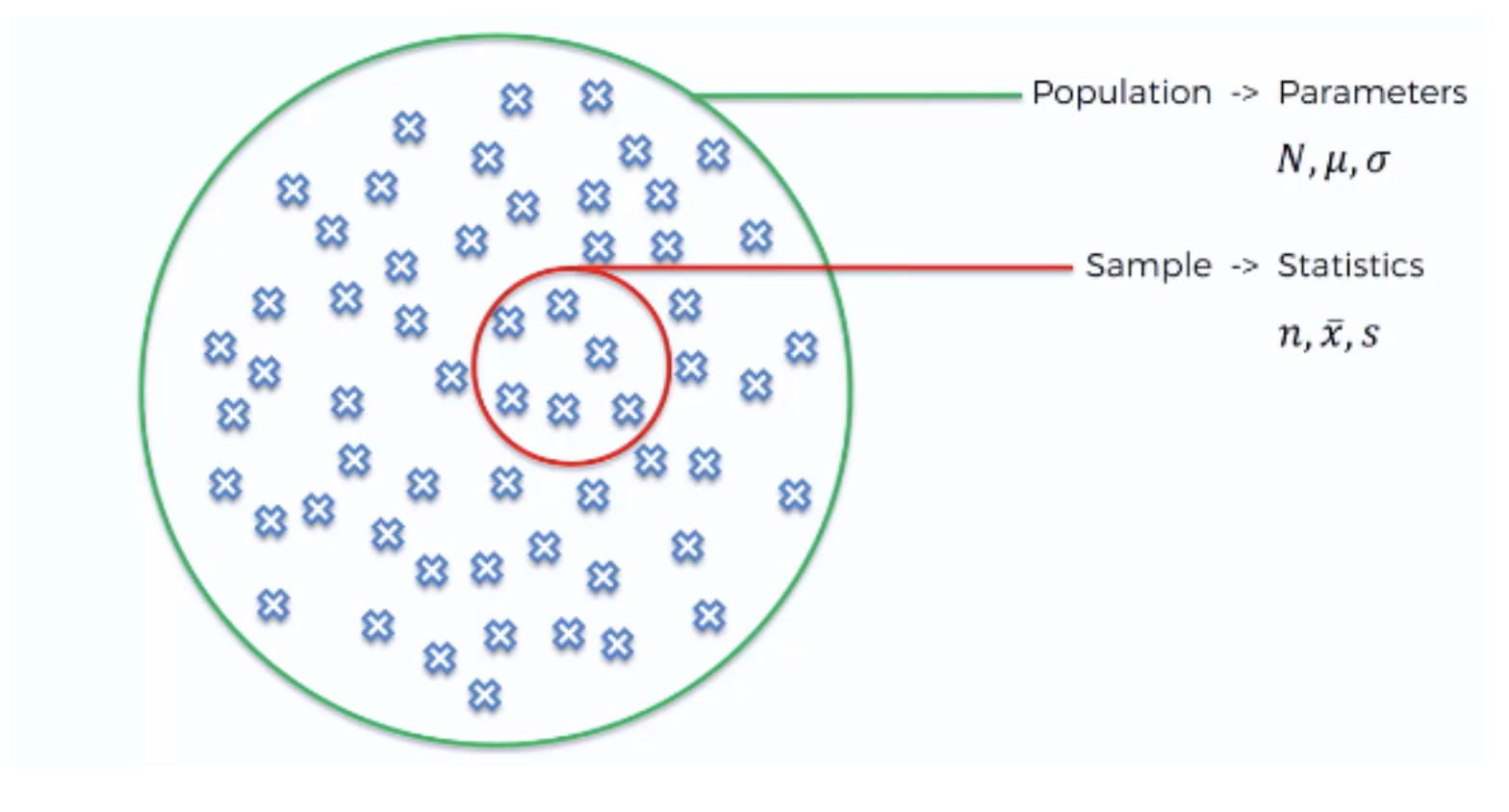

Parameter vs estimate

| population | sample | |

|---|---|---|

| name | parameter | estimate |

| mean | \(\mu\) | \(\bar{x}\) |

| variance | \(\sigma^2\) | \(s^2\) |

standard deviation |

\(\sigma\) | \(s\) |

| size | \(N\) | \(n\) |

Visually

Your turn

Click here or the qr code below